How smaller banks are landing bigger talent

Silicon Valley’s attempted move into financial services has reached a fever pitch in 2019: Facebook’s gambit on cryptocurrency was revealed in June, the Apple Card was released in August, and now Robinhood has trolled every major online stock brokerage into completely dropping their trading fees. Big Finance is taking some big hits when it comes to tech innovation.

If you’re a bank, you’re probably used to this by now. It can be tough for the highly regulated, fiscally conservative finance industry to react quickly to challenges from the more agile tech industry. As an alternative to building new capabilities in-house, many big banks are forming partnerships with smaller FinTech firms. But much like their counterparts in the defense industry, big banks will also need to start building more adaptive company cultures. If they don’t, they’re going to struggle to attract the younger top tech talent who are creating the software that’s rapidly invading the financial services sector.

What big banks can learn from their smaller, nimbler counterparts

Big banks don’t have to look outside their own industry to find models of more adaptive culture. Textio compared the typical hiring language of five of the world’s largest employers in the banking industry to five of their smaller financial industry competitors, and uncovered some striking differences in how each group sounds to job candidates.

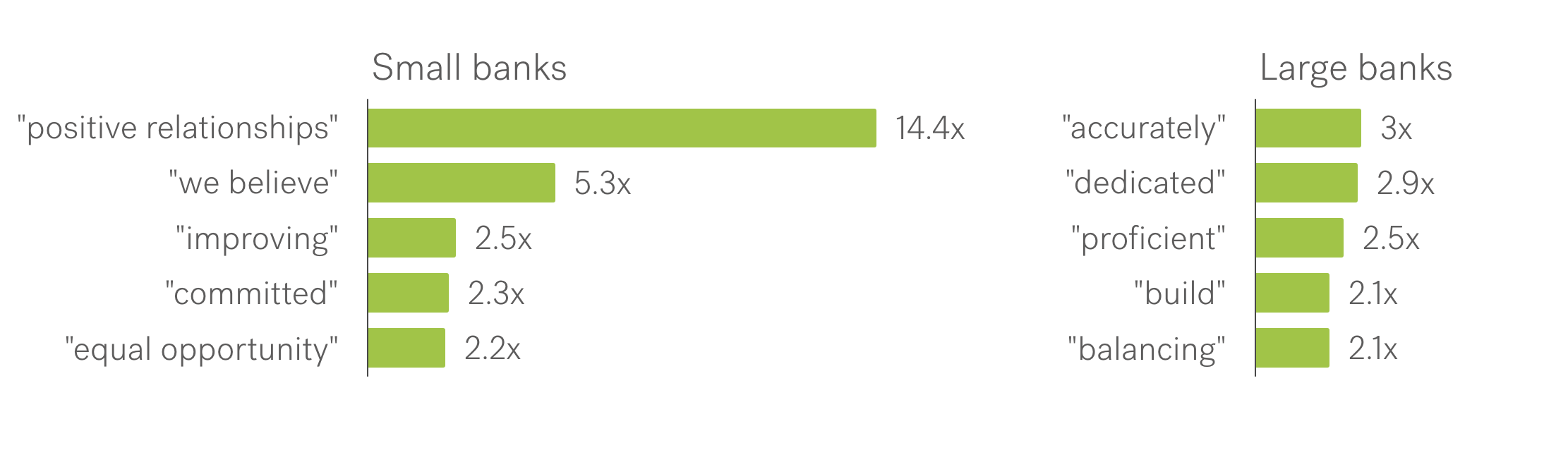

The most apparent difference is that large banks use far more language that is statistically proven to slow down the hiring process, because they’re phrases that tend to alienate the most qualified candidates. Much of this distinctive language is classic business jargon, which is exactly what people might expect from big, old banks.

Overall, big banks* use 2.75 times more distinct jargon phrases in their hiring language.

Not only are big banks using more jargon, but they also have less distinct language that is optimistic or is known to speed up time to fill for a role. Small banks, for example, use language that depicts a more nimble and open culture, talking about positive relationships fourteen times more than big banks, and we believe five times more. Conversely, big banks are far less likely to frequently use positive phrases.

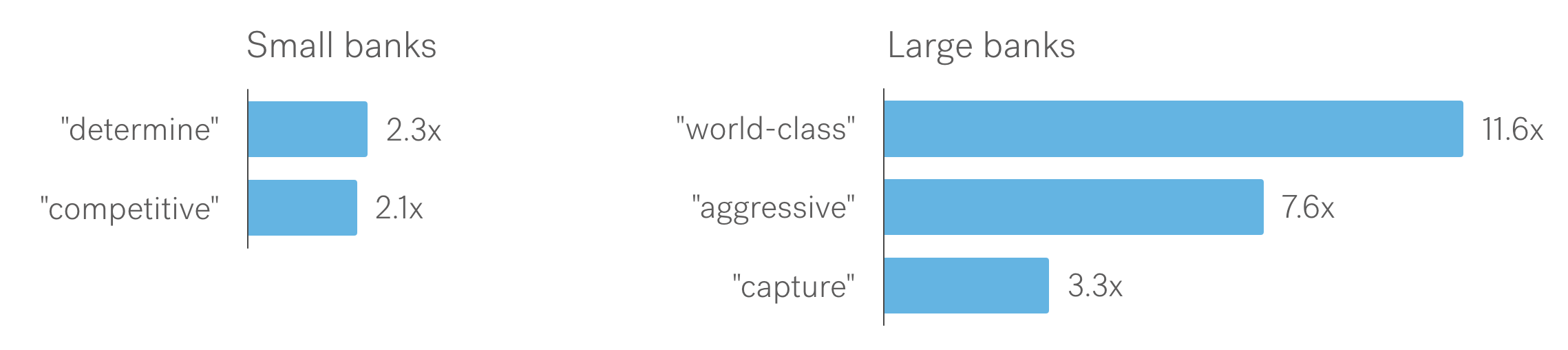

Large banks are also inclined to use statistically masculine language more often and at a higher frequency relative to other categories of language. On average, they use 1.75 times more masculine language than their smaller counterparts. Phrases like aggressive and capture work in direct opposition to diversity and inclusion efforts and hinder the ability of larger institutions to create an inclusive and balanced workplace.

Time for big banks to invest in a new (cultural) wardrobe

According to the US Bureau of Labor Statistics, over half of the workers in the financial service sector are now millennials, a number that’s only going to increase. This generation is not afraid to leave old institutions behind to seek out more adaptive and innovative work cultures that align with their values. And when they do, they’re taking with them the technological know-how required to keep banks in the game.

Putting your best words and values forward is key to winning the talent race, and right now the language data shows that big banks are falling behind.

*Bank size determined by total number of employees in October 2019